Stock Index After Hours

Stock Index Algo (MMXXIII)An automated trading strategy for the Tradestation platform that takes advantage of the tendency for smooth night time trends on the long side ...

Our trading systems are algorithmic or rules based and are used to make trading decisions in the financial markets and generate long and short trading signals that can be traded automatically in the futures, ETF’s, and stock markets around the world. Our strategies can be leased or purchased and fully automated on your computer or server.

Due to the complexity of Market Timing & Systematic Entries, we do not sell strategies off the shelf in order to avoid automating a strategy in a drawdown period. Instead we offer a comprehensive One-on-One consulting regime utilizing our robust Money Management Algorithms before going live into the markets. This approach has proven to be very effective and successful.

Trading system portfolios are developed by combining different trading algorithms that use different methods in order to seek reduced risk through diversity.

Multi-market, multi-strategy trading systems that trade trend and counter trend approaches provide opportunities in every type of market environment.

Experience in the markets and understanding each systems response to certain market conditions will allow for a determination of which systems will work best in current market environments.

Algo Charts Pro specialize in Data Mining and programming robust Algo's based on quantative methods. If you have any conceptual thoughts that you would like coded, please Contact Us below for your free consultation. We have an exhausted library of data mining Algo's ready to be leased, we may already have something coded for you.

The money management algorithm will only allocate real trades when the trend of the equity curve is up.

Another example of one of our systematic money management algorithms is to stop trading at a pre-defined draw down and then to start again once there has been a run up of a predetermined amount from the equity curve lows.

Our Money Management Algorithms have 12 different rules that can be applied to individual trading systems to manage the equity curve of a strategy.

Today's Trader relies on Indicators and Rules to make decisive entry & exit decisions. If you have any conceptual thoughts that you would like coded, please Contact Us below for your free consultation. We have an exhausted library of indicator based Algo's ready to be leased, we may already have something coded for you.

Our unique Money Management Algorithm tool is a "trading system for a trading system", or an algorithm that can be used to manage your trading system by monitoring the equity curve of the strategy or strategies you are trading. If you want to set up rules to limit your risk by monitoring the equity curve or if you want to improve your entry efficiency by testing different and delayed entry methods, the money management algorithms can backtest and automate your ideas.

An automated trading strategy for the Tradestation platform that takes advantage of the tendency for smooth night time trends on the long side ...

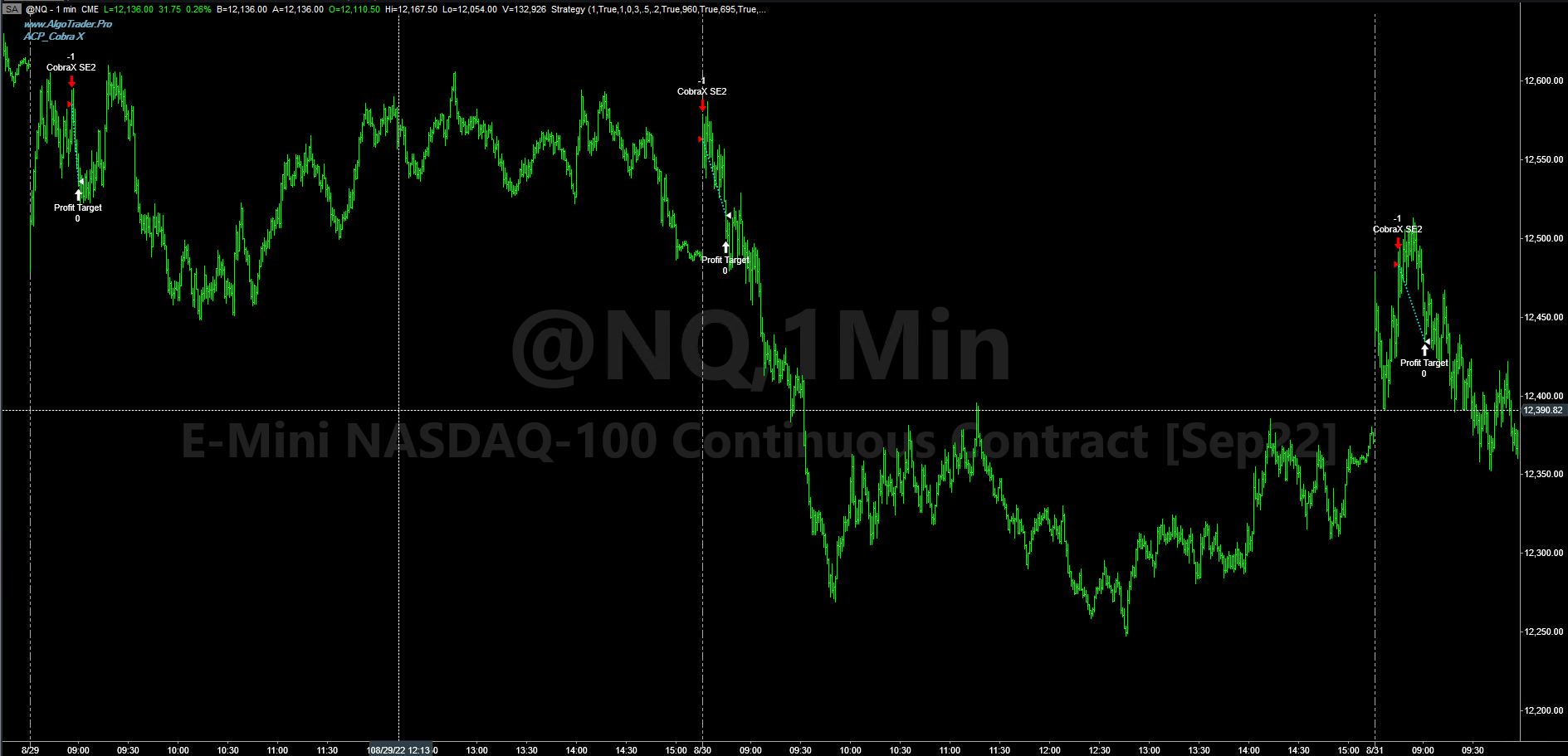

Cobra X Nasdaq Algo trades in the direction of strong and well established intra-day trends. Best described as a "Middle Trend Finder" ...

Stock Index GAP Fill is automated in traditional GAP Fill fashion with a proprietary Machine Learning trend twist yielding better trade entries ...

Algo Chart Pro is a software company. We are not in the business of providing financial or investment advice, nor are we registered with the proper authorities to do so. The product we provide (both the software and its associated documentation, examples, etc.) is for educational purposes only and should never be construed as providing trading or investment recommendations or advice. Any decisions you make using this product are made at your own risk and are yours and yours alone. Remember that trading is inherently risky, and traders may sustain losses greater than their investments regardless of which asset classes are traded. Before trading, carefully consider the risks involved in light of your financial condition and never trade money you can't afford to lose.

Required US Government Disclaimers: Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed here. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN ACTUALLY EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.